The Time of Day Effect: A Breakthrough in Trading Cost Optimization

July 14, 2025

The Time of Day Effect

Algorithmic traders have long focused on cost-saving opportunities such as optimizing execution speed, improving order placement, curating liquidity, capturing short-term alpha, and minimizing latency. While these approaches have delivered incremental improvements, recent research suggests that the timing of execution itself may offer a far greater opportunity to reduce trading costs.

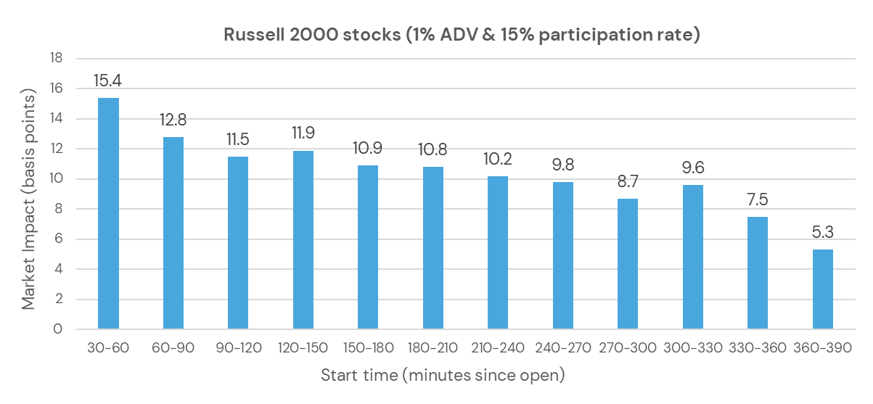

The study, The Time of Day Effect, examines the variability in trading costs across the trading day, holding participation rate and order size constant. This effect is distinct from volume-driven effects, as many algorithms already spread orders proportionally in accordance with intraday volume. The findings indicate that executing the same order in the final hour of the trading session is consistently less costly than executing it earlier in the day.

To learn more, request the full research paper now.

.svg)